Efficiently Manage Law Society Third Party Invoices: Your Ultimate CTA Solution

Law Society Third Party Invoices

Introduction

Welcome, readers! Today, we will discuss an important topic that concerns the legal profession – Law Society Third Party Invoices. In the legal industry, it is common for law firms to engage third-party service providers to assist in various aspects of their practice. These service providers can include court reporters, expert witnesses, and document production companies, among others. Law Society Third Party Invoices refer to the invoices issued by these service providers to law firms for the services rendered. In this article, we will delve into the details of Law Society Third Party Invoices, exploring what they are, who is involved, when they are issued, where they are applicable, why they are important, and how they can be managed effectively.

1 Picture Gallery: Efficiently Manage Law Society Third Party Invoices: Your Ultimate CTA Solution

What are Law Society Third Party Invoices?

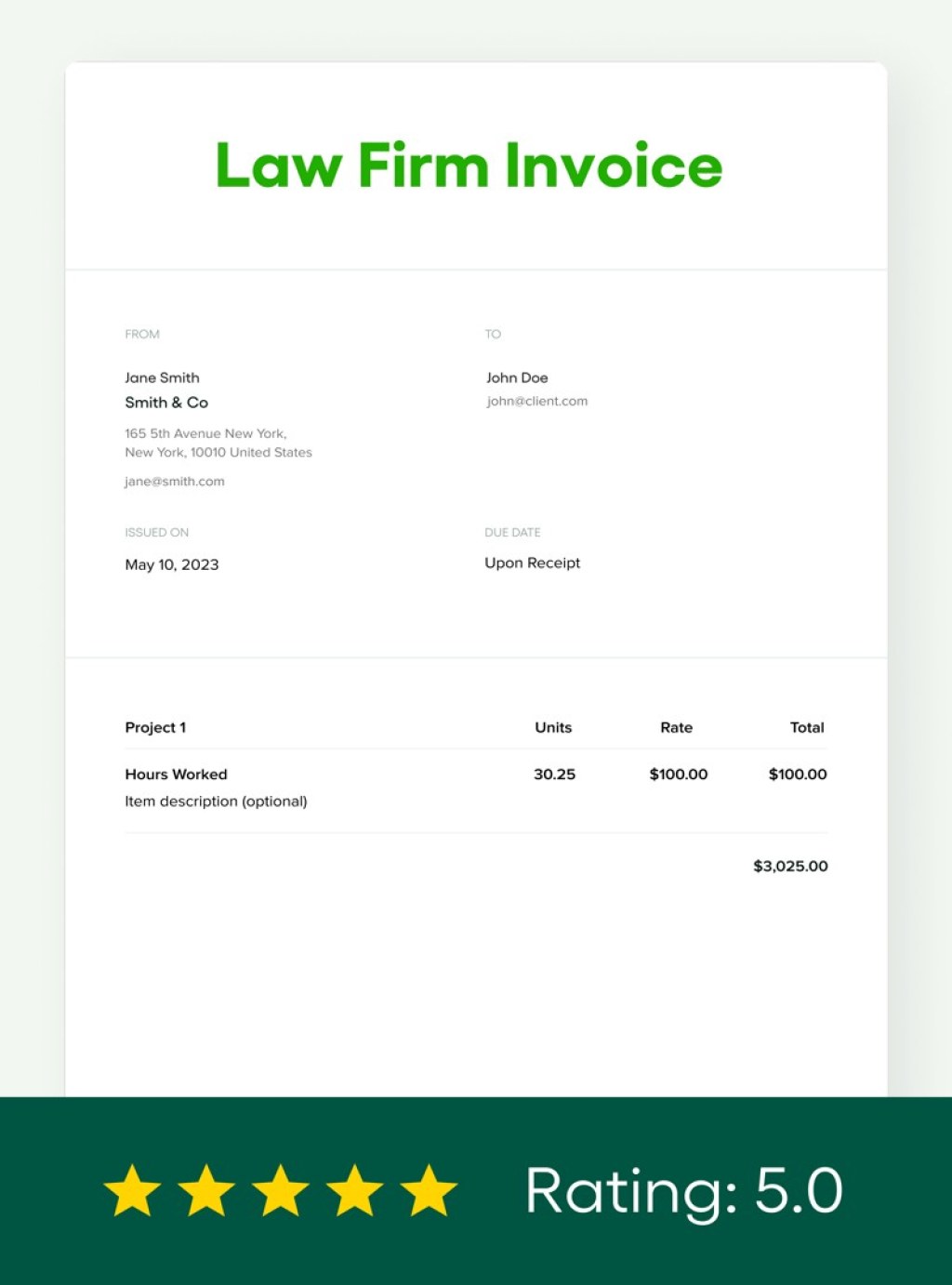

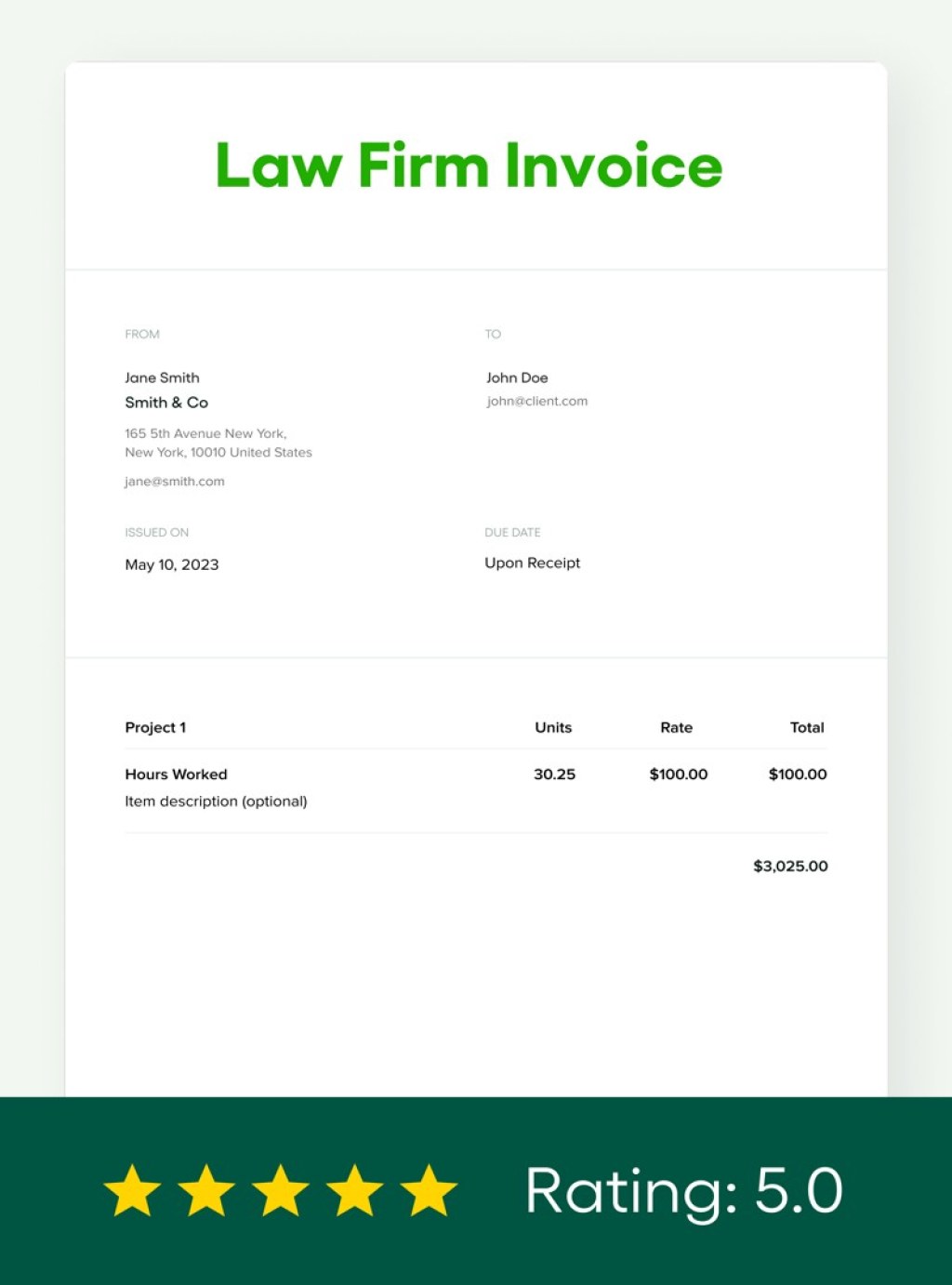

🔎 Law Society Third Party Invoices are invoices issued by service providers to law firms for the services they have provided. These invoices reflect the costs incurred by the service providers and are submitted to the law firms for payment. They serve as documentation of the services rendered and the associated costs.

Who is Involved?

Image Source: website-files.com

🔎 Law Society Third Party Invoices involve two primary parties – the service providers and the law firms. The service providers can vary depending on the specific needs of the law firms, but commonly include court reporters, expert witnesses, and document production companies. The law firms engage these service providers to support their clients’ legal matters.

When are Law Society Third Party Invoices Issued?

🔎 Law Society Third Party Invoices are typically issued after the service providers have completed their assigned tasks. The timing of the invoice issuance can vary depending on the agreement between the service provider and the law firm. In some cases, the invoices are issued on a monthly basis, while in others, they are issued upon completion of specific services.

Where are Law Society Third Party Invoices Applicable?

🔎 Law Society Third Party Invoices are applicable in the legal industry, where law firms require the expertise and assistance of third-party service providers. These invoices are relevant in various legal proceedings, such as litigation, arbitration, and transactional matters.

Why are Law Society Third Party Invoices Important?

🔎 Law Society Third Party Invoices play a crucial role in the financial management of law firms. They provide transparency and accountability in billing for the services provided by third-party service providers. Law firms rely on these invoices to accurately track and allocate costs to their clients’ matters. Additionally, these invoices serve as supporting documents for disbursement claims and are essential for accurate financial reporting.

How to Manage Law Society Third Party Invoices Effectively?

🔎 Managing Law Society Third Party Invoices effectively involves several key steps. First, law firms should establish clear guidelines and procedures for engaging and billing third-party service providers. This includes setting expectations on billing rates, invoice formats, and payment terms. Second, implementing robust invoice tracking systems can help streamline the management of these invoices. This can include utilizing software solutions specifically designed for legal billing. Third, regular review and reconciliation of the invoices against the services provided can help identify any discrepancies or errors. Finally, open communication and prompt payment to the service providers are crucial to maintaining strong working relationships and ensuring a smooth invoicing process.

Advantages and Disadvantages of Law Society Third Party Invoices

Advantages:

1. 💼 Enhanced Efficiency: Law Society Third Party Invoices streamline the billing process, allowing law firms to accurately track and allocate costs to specific matters.

2. 💼 Transparent Billing: These invoices provide transparency and accountability, ensuring that clients are aware of the services rendered and the associated costs.

3. 💼 Accurate Financial Reporting: Law Society Third Party Invoices serve as supporting documents for financial reporting, contributing to accurate and reliable financial statements.

4. 💼 Professionalism: Utilizing Law Society Third Party Invoices showcases the professionalism and accountability of law firms in managing their clients’ affairs.

5. 💼 Expense Recovery: These invoices facilitate the recovery of expenses incurred by law firms when engaging third-party service providers.

Disadvantages:

1. ⚠️ Additional Administrative Burden: Managing and processing Law Society Third Party Invoices can be time-consuming and require significant administrative resources.

2. ⚠️ Cost Considerations: Depending on the nature and complexity of the legal matter, the costs associated with engaging third-party service providers can be substantial.

3. ⚠️ Dispute Resolution: In some cases, disputes may arise regarding the services rendered or the accuracy of the invoiced amounts, leading to potential conflicts between law firms and service providers.

4. ⚠️ Cash Flow Management: Prompt payment of Law Society Third Party Invoices can impact the cash flow of law firms, especially if the invoices are substantial in amount.

5. ⚠️ Reliance on Service Providers: Law firms are dependent on the expertise and availability of third-party service providers, which can introduce risks if the service providers fail to deliver as expected.

Frequently Asked Questions about Law Society Third Party Invoices

1. Can law firms negotiate the billing rates stated in Law Society Third Party Invoices?

Yes, law firms can negotiate the billing rates with the service providers. However, it is important to maintain transparency and fairness in the negotiation process.

2. Are Law Society Third Party Invoices subject to taxation?

Yes, Law Society Third Party Invoices are generally subject to taxation. However, the specific tax implications may vary depending on the jurisdiction and the nature of the services provided.

3. How can law firms ensure that the services stated in the invoices were actually provided?

Law firms can implement robust systems to track and verify the services provided by third-party service providers. This can include maintaining detailed records, conducting regular audits, and utilizing technology solutions for invoice management.

4. What should law firms do if they dispute the accuracy or validity of a Law Society Third Party Invoice?

If there is a dispute regarding a Law Society Third Party Invoice, law firms should engage in open communication with the service provider to resolve the issue. If necessary, they can involve relevant professional organizations or seek legal advice.

5. Can law firms pass the costs stated in Law Society Third Party Invoices directly to their clients?

Law firms can pass the costs stated in Law Society Third Party Invoices to their clients, subject to the terms of their fee agreements and any applicable legal or ethical considerations.

Conclusion

In conclusion, Law Society Third Party Invoices play a vital role in the legal industry, ensuring transparency, accuracy, and accountability in billing for third-party services. Law firms must effectively manage these invoices to maintain financial stability and provide reliable services to their clients. By establishing clear procedures, utilizing technology solutions, and fostering open communication with service providers, law firms can optimize their invoicing processes and enhance their overall practice management.

Final Remarks

Disclaimer: The information provided in this article is for general informational purposes only and should not be construed as legal advice. Consult with a qualified legal professional for specific guidance related to Law Society Third Party Invoices or any other legal matters.

This post topic: Law and Society